Tallie Glossary

Accounting, Business Expense & Technology Definitions

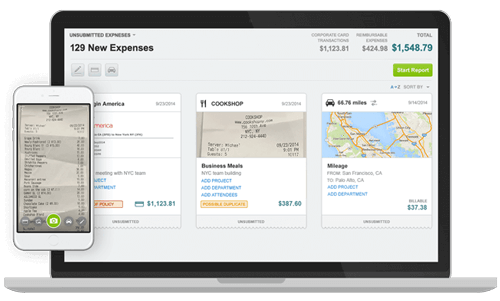

Below is a series of terms regularly used during accrual of business expenses, corporate credit card transaction management and expense report accounting processes, plus a slew of accounting terms. Tallie Expense Report Software provides this quick reference sheet for reference to expense submitters, accountants and business owners alike.

- Accounting

- The measurement, processing and reporting of financial information for an economic entity. See also Chart of accounts.

- Accounting period

- The time period for which financial information is tracked and reported. Most businesses track their financial results on a monthly, quarterly and annual basis. See also Bookkeeping.

- Accounts receivable

- Money owed to a business by its customers.

- Accounts payable

- The account used to track all outstanding bills from vendors, contractors, consultants, and any other companies or individuals from whom the company purchases goods or services.

- Accounting data synchronization

- The process of establishing consistency among data from a source such as a credit card to an accounting software platform. See also Activity based sync.

- Accounting software

- A computer application that tracks and records financial transactions and provides reporting and analysis. See also Accounting software stack.

- Accounting software stack

- A set of programs that work together to maintain the financial representation of the business; typically a central ERP and its peripheral applications. See also Enterprise resource planning ("ERP") software.

- - top -

- Accounting system

- Organized set of manual and computerized accounting methods, procedures, and controls established to gather, record, classify, analyze, summarize, interpret, and present accurate and timely financial data. See also Accounting software.

- Activity based sync

- A method of data synchronization between two systems wherein a change made to data in one of the systems triggers an action, resulting in integrated and identical data structures.

- Amortization

- The allocation of the cost of an intangible asset over its its useful life.

- Application programming interface ("API")

- A set of rules, protocols and routines used for completing operations with a software system. Typically, an API is established to facilitate communications with external systems. See also Bi-directional integration and Enterprise resource planning ("ERP") software

- Approval chain

- The sequence of stages, paths and steps defined by a series of rules established by management and finance teams required for completing a business process. See also Approval chain configuration.

- Approval chain configuration

- Configuring the sequence of stages, paths, and steps that will be taken for approving a business process. See also Approval chain.

- Artificial Intelligence

- Software capable of performing tasks that would normally require human intelligence, such as sight.

- - top -

- Asset

- Property owned by a company that will provide a future, measureable benefit. See also Balance sheet, Equity and Liabilities.

- Auto Categorization

- Automatically assign category and based on scanned document content.

- Automation

- Configuring of a manual action to be performed by machines or software rather than humans.

- Automatic data synchronization

- The process of sending data back and forth between two connected software systems, resulting in an identical data set. See also Accounting data synchronization.

- Balance sheet

- The financial statement that presents a snapshot of the company's financial position as of a particular date in time. See also Financial statement, Income statement, Cash flow statement, Asset, Equity and Liabilities.

- Billable

- Time or expenses that are chargeable to a client. See also Accounts payable and Accounts receivable.

- Bi-directional integration

- Software integration where data flows between two systems. See also Application programming interface ("API"), Accounting data synchronization, and Activity based sync.

- Bookkeeping

- The process of maintaining entries in the journals and general ledger. See also Journals, General Ledger, Chart of Accounts and Accounting Period.

- - top -

- Business class software

- Software that is developed to meet the demands of a core business function and its users' standards and requirements. See also Enterprise software.

- Cash flow statement

- The financial statement that tracks the movements of cash for operating, investing, and financing activities over an accounting period. See also Financial statement, Income statement, Balance sheet.

- Categorization

- The assignment of each component of a journal entry to a single account in the chart of accounts. See also Chart of accounts, Dimensions, List data and Financial statement.

- Chart of accounts

- A list of the asset, liability, equity, revenue and expense accounts used by an organization for recording transactions and compiling financial statements. See also Income statement, Balance sheet, Categorization and Double-entry accounting.

- Cloud-based computing

- Storing and accessing data and programs over the Internet instead of a computer's hard drive. The cloud is a common metaphor for the Internet. See also Software as a Service ("SaaS")

- Cloud-based accounting

- The measurement, processing and reporting of financial information of an economic entity using Cloud-based software (typically SaaS) as opposed to an on-premise accounting system. See also: Cloud-based computing

- - top -

- Credit

- The right side of a T-account. Generally, an entry that increases a liability, revenue or equity account and decreases an asset or expense account. See also: Debit.

- Credit card reconciliation

- The process wherein a company's record of credit card transactions are compared against the official monthly statement from the issuing bank, ensuring that each transaction is accurate and entered correctly in the accounting system. See also Non-reimbursable expenses and reimbursable-expenses.

- Credit card transaction management

- A series of duties at the end of each credit card statement cycle to ensure proper accounting of the transactions. See also Non-reimbursable expenses, Reimbursable expense and Source documentation.

- Corporate expense policy

- Conduct and rules that outline the allowable and non-allowable expenses employees may incur on behalf of a company. See also Non-reimbursable expenses and Reimbursable expenses.

- Cost of goods sold ("COGS")

- All of the costs incurred to acquire inventory and get it ready for sale to customers. See also Income statement, Expense, Income account and Revenue.

- Cost of sales

- A generalized form of cost of goods sold that may or may not include the associated costs of inventory.

- - top -

- Data entry

- The process of entering information into a computerized database or spreadsheet. See also Expense report automation and Internal controls.

- Data transfer

- The physical transmission of data from one point to another point or other points.

- Depreciation

- Allocating the cost of a fixed asset over its its useful life. You know how people say, "That brand new car loses a quarter of its value the second you drive it off the lot,"? They're talking about depreciation. See also: Amortization

- Debit

- The left side of a T-account. Generally, an entry that increases an asset or expense and decreases a liability, revenue or equity account.

- Debt

- An obligation to pay something of value to another party. Short-term debt is due in less than one year. Long-term debt is due in more than one year. See also: Liability

- Deferrals

- Accounting revenues or expenses that are not immediately recognizable on the income statement may be deferred until a future time. For example, cash received for services that have not yet been completed may be accounted for as deferred revenue until the services are complete.

- Dimension

- A value or set of values that can be used for analysis on a data set.

- - top -

- Double-entry accounting

- Each side -- that is, debits and credits -- of every financial transaction entered must equal, thereby satisfying the basic accounting equation, Assets = Liabilities + Equity.

- Earnings before interest, taxes, depreciation and amortization ("EBITDA")

- A common profitability metric that equates to net income with interest, taxes, depreciation and amortization added back.

- Employee business expenses

- Costs incurred by employees in the course of conducting business activities. They are generally reimbursable.

- Enterprise resource planning ("ERP") software

- An application that integrates a company's back-office functions such as accounting, product planning and human resources. An advantage to ERP software is that all of the data is shared in a single system instead of residing across multiple disparate systems.

- Enterprise software

- Applications designed for businesses, non-profits, governments (as opposed to individuals). See also: Enterprise resource planning ("ERP") software

- Expense

-

- Noun: A cost incurred. Within an enterprise, an expense is a cost that is incurred in the course of conducting business.

- Verb: To charge a cost incurred back to a business, usually by an employee. See also: Employee business expenses

- Expense account

- An arrangement wherein an enterprise permits an employee or other individual to incur expenses in the course of business.

- - top -

- Expense report management

- A system of rules implemented by a business to process, pay and oversee expenses incurred by employees. Businesses implement these policies and rules to keep spending in check and to prevent and deter fraud.

- Expense policy rules engine

- Software that executes guidelines developed for the purpose of managing employee expenses. A policy such as, "All employee expenses over $25 require a receipt" or "Airfare over $500 requires prior approval" can be configured to meet the business needs of the customer via an expense policy rules engine separate from the application's programming.

- Expense report

- A record of out-of-pocket and costs incurred by an employee that is submitted to an employer for reimbursement.

- Expense report automation

- The conversion of human-prepared expense reports to those prepared by computers or applications.

- Expense report software

- An application that automates, analyzes and reports on costs incurred by an employer's employees. See also: Expense report automation.

- Expense report software integration

- To combine and make compatible the functions of expense report software with various other applications.

- Expense report template

- A generic, patterned document or spreadsheet for employees to fill out and submit to their employer in order to have expenses reimbursed.

- - top -

- Expense voucher

- A document that entitles you to something or that serves as proof of some expense. Like when your flight is oversold and the airline attempts to bribe people to give up their seat; an airline will usually give people willing to be bumped vouchers for food or even towards the purchase of a future flight.

- Equity

- The difference between the assets and liabilities of something owned. In a business, it consists of all investment by the owners along with the net earnings or losses and less any distributions to the owners.

- Financial statement

- A document of accounting information with a defined format. The most common financial statements are balance sheet, income statement, statement of shareholders' equity and statement of cash flows.

- Fixed asset

- A noncurrent asset, one that is expected to be service to a business for multiple years and depreciated over the course of its useful life. See also: Depreciation

- General ledger

- Where all accounting transactions are posted from various journals. Often referred to as the "GL."

- Gross margin

- A financial metric, often expressed as a percentage, that measures the amount of sales retained after taking into account cost of sales. Calculated by dividing revenues less cost of sales by revenues.

- - top -

- Income account

- A general ledger account that includes revenues and gains that are reported on an income statement.

- Income statement

- A financial statement that presents the revenue, expenses, gains and losses to arrive at a net income or loss for a given period of time, usually a quarter or year.

- Integration platform as a service - (iPaaS)

- A platform that connects and makes compatible groups of cloud-based and on-premise programs to create a seamless, cohesive computing system within an enterprise.

- Internal controls

- A documented set of actions, checks and balances, policies, protocols and reviews that ensure the financial information reported by an accounting system is accurately and consistently applied and recorded in compliance with applicable standards.

- Integration

- The combining of compatible applications so that they may work together harmoniously.

- - top -

- Interest

-

- The cost to borrow money. When a bank loans money to a borrower, that borrower must repay the total amount of the principal but also incurs an expense to borrow the money. That expense is determined by a percentage rate that is applied over the course of term of the loan.

- The ownership stake in a business, property or other asset. If you and your brother bought a building and agreed to split the purchase price evenly, you would each have a 50% interest in the building.

- Invalid business expense

- A cost incurred by an employee in the course of doing of business that is not authorized, usually due to a policy or rule that deems it non-allowable.

- Inventory

- The stuff a business has on hand to sell to its customers. May also include the raw materials used by a business in the creation of goods for sale.

- Invoicing process

- A set of instructions, rules and policies, typically used by an accounts payable department, for processing bills sent to a company.

- Inventory item

- As opposed to a service item, a distinct good that is available for sale to a customer.

- Item

- This term is used in accounting systems and represents something this is sold. The name of the item typically appears in inventory reports and on invoices.

- - top -

- Journal entry

- The recording of a single transaction that increases one or multiple accounts and decreases one or multiple accounts. The net effect of every journal entry in a double-entry accounting system is zero (i.e. debits equal credits). All journal entries are posted to the the general ledger.

- Journals

- A chronological record of journal entries. There are various journals in an accounting system but the most common are cash receipts, cash payments, general, purchases, purchases returns, sales and sales returns.

- Liabilities

- An obligation to pay a stated financial amount at a future date. If you borrow $1,000,000 from a bank, you are obligated to repay that balance in the future with interest. These balances, both individually and collectively, are liabilities. See also: Debt.

- Line Item

- Separates each entry into individual lines.

- Line Item Rejection

- The ability to reject a single line item as compared to an entire report.

- List data

- The detailed information of various lists present in accounting systems including vendors, employees, clients, jobs, departments, accounts.

- Manual entry

- The recording of data by hand, whether into a physical or computerized medium.

- Net income

- The final earnings or profit of an enterprise for an accounting period. Calculated by the sum of all revenues less all expenses.

- - top -

- Non-reimbursable expense

- A cost incurred by an employee that will not be paid back by the employer, usually due to a policy or rule that forbids the repayment.

- OCR

- A technology designed to extract text from an image and convert it into editable and searchable data.

- Operating margin

- The ratio of operating income (revenue less cost of production) to net revenue that measures the efficiency of the business's activities.

- Optical Character Recognition

- A technology designed to extract text from an image and convert it into editable and searchable data.

- Outsourcing

- The transfer of a business process or function to a third-party provider.

- Purchasing card ("P-card")

- A charge card issued by a company to employees for making small purchases. P-cards can reduce the time and cost of preparing and reviewing employee expense reports as well as the lag time between submission and reimbursement.

- Pattern Recognition

- A branch of machine learning that focuses on the recognition of patterns and regularities in data.

- Payroll

-

- A record of a company's employees along with their compensation and corresponding deductions like taxes and deferred pay.

- The total amount of compensation paid by an employer to its employees.

- The department that handles the administration and oversight of compensation within a company.

- Prepaid business card

- A charge card that helps control employee spending via pre-approved purchases, allocated funds, and restricted spending in specific categories.

- Profit

- The net positive result of a company's revenues, cost of sales, expenses, gains and losses. See also: Net income

- - top -

- Receipt

- Written evidence of a payment. It could be for the purchase of goods or services and will include the amount paid and the date of the transaction.

- Reimbursable expense

- A cost incurred by an employee in course of doing business that is eligible for reimbursement by employer.

- Reimbursable out-of-pocket expenses

- Cash payments that an employee or other individual incurs on behalf of a company that will be refunded in the future.

- Reimbursement

- The payment of an expense by a person, business or other entity that was incurred by another individual.

- Return on investment (ROI)

- A formula used to evaluate the performance of an investment relative to the its cost, expressed as a percentage or a ratio. You always hear accountants asking, "What's the ROI?" when they are skeptical of spending money on something.

- Revenue

- The income received from the sale of a good or service. Often the first item at the top of a company's income statement.

- - top -

- Seamless expense report workflow

- An uninterrupted integration of employee expense reports into the accounting information system of a business, government, nonprofit or other entity.

- Service item

- An item that is related to a service that is sold by a company. This is distinguished from a physical good. See also: Item

- Service Organization Control ("SOC") Report

- An internal control report provided by a third-party that discusses the risks associated with an outsourced service.

- Small and medium-sized business ("SMB") software

- Computer programs that are built for enterprises that have basic needs for functions like accounting or scheduling. These applications are meant to flexible, easy to use and adequate for many business needs.

- Software as a Service ("SaaS")

- A software hosted and distributed by a vendor or service provider made available to customers over the Internet. Frequently confounded with the cloud.

- Source documentation

- A document that validates an accounting transaction or balance. For example, bank statements, invoices and receipts are all examples of a source document.

- Spreadsheet expense reports

- The use of a spreadsheet application to organize and recount the expenses incurred by an employee for a given period of time, usually a month and submitted for reimbursement.

- Standalone system

- An individual application functioning autonomously from other applications.

- Structured Document

- Documents with a static layout such as checks.

- Supervised Learning

- A type of pattern recognition that analyzes data based on existing patterns.

- - top -

- Trial balance

- A report of all the general ledger accounts in a financial reporting system and their numerical balances at a given point in time.

- Value-added service

- A practice or action that increases the worth of the entity it is provided to.

- Unstructured Document

- Documents that vary in formatting such as bills and receipts.

- Unsupervised Learning

- A type of pattern recognition that analyzes data to identify new patterns.

- - top -